A Simple Process for Impactful Funding

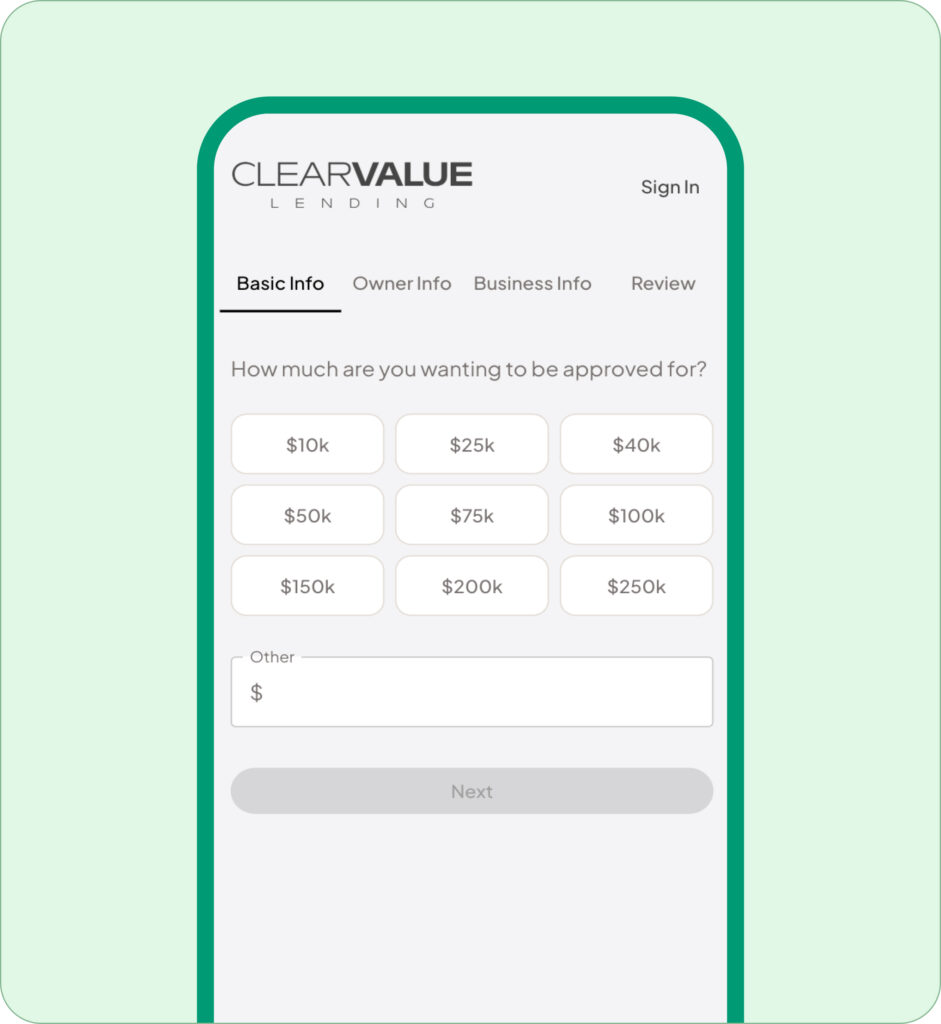

Start Application

Complete our quick, secure application in just a few minutes.

Receive Approval Decision

Receive an approval decision without impacting your credit score.

Choose Terms That Fit You

You have the power to choose the loan terms up to the maximum approved terms.

Get Your Funds

Funds are deposited into your account the same day upon approval.

Our Commitment

We prioritize your privacy and security, employing advanced encryption and cybersecurity measures to protect your personal and financial information. As a modern, technology-first company, ClearValue Lending is able to respond with extreme agility to the growing threat of cyber security risks.

Your Questions,

Answered

How Do I Get Started with ClearValue Lending?

Getting started is fast and easy. Simply complete our fully automated online application—it takes just a few minutes! Once you submit your application, you’ll receive a confirmation without affecting your credit score. Approved funds are deposited directly into your account after approval and contracts are signed, so you can focus on growing your business.

What Are the Basic Requirements for Business Financing?

- Minimum credit score of 550 FICO.

- At least $10,000 in monthly revenue.

- Business operating for at least 1 year.

What Are My Chances of Getting Approved?

We’ve made our eligibility criteria straightforward to support small businesses. To qualify, you need a FICO score of at least 550, $10,000 in monthly revenue, and at least one year in business. We understand that no two businesses are alike, so we assess applications holistically to find the best funding solution for you.

How Fast Can I Get My Funds?

Will Applying Impact My Credit Score?

What Can I Use the Loan Funds For?

Can I Customize My Loan Terms?

Are ClearValue Lending Loans Secured or Collateral-Free?

What Are Unsecured Business Loans, and How Do They Work?

How Long Does It Take to Complete the Loan Process?

Why Do I Need to Link My Bank Account with Plaid™?

How Do I Know My Information Is Secure?

We’re here for small business owners who need quick, reliable funding. Whether you’re a startup scaling operations or an established business managing cash flow, ClearValue Lending provides solutions tailored to your unique needs.

What Happens If I Pay Off My Loan Early?

Some funding approvals can come with an Early Payoff Agreement (EPA for short) that breaks down different time intervals with discounts tied to it. If you get an approval without an EPA and you intend to pay off early, you have full control over the financing parameters to set your ideal funding amount and duration (called term) that you wish to pay back within.

What Makes ClearValue Lending Different from Other Lenders?

Who Is ClearValue Lending Best Suited For?